Export/Import Code (IEC)

Get Assistance with Your Import Export Code (IEC) Application Today!

Price: Rs. 1999/- (All-Inclusive)

Fast & Reliable Service

Fast, Affordable, and Hassle-Free Modifications

Our Simple 4-Step Process

We Handle the Details, You Focus on Your Business

Consult Our Experts

We have the best business experts who can resolve all your queries

Submit Required Documents

Provide all the documents. Our team will initiate the paper work on your behalf

Efficient Document Processing

The document filing process will commence through the designated portal

Receive Your IEC Certification

IEC certificate approved; certificates will be sent soon.

IEC Registration Overview :

The Import Export Code (IEC) is a 10-digit alphanumeric identification number crucial for entities involved in international trade. Issued by the Directorate General of Foreign Trade (DGFT) or the relevant government authority, the IEC serves as a lifetime unique identifier, streamlining customs clearance, facilitating foreign exchange transactions, and ensuring legal compliance. The application process, often conducted online, requires submission of essential documents such as PAN card, address proof, and bank details. Amendments for changes in business details can be requested, and the IEC, once obtained, is used in all international trade communications and documentation. Its significance lies in its mandatory requirement in many countries, making it an indispensable tool for businesses participating in legal and regulated cross-border transactions.

Benefits:

Import/export registration offers several benefits for businesses engaged in international trade. Here are some of the key advantages:

1. Access to Global Markets: Registration allows businesses to legally import and export goods, expanding their market reach beyond domestic borders.

2. Trade Compliance: Being registered helps ensure compliance with international trade regulations, reducing the risk of legal issues and fines.

3. Customs Benefits: Registered businesses often benefit from streamlined customs procedures, reducing delays and simplifying the import/export process.

4. Business Credibility: Having import/export registration adds credibility and demonstrates a commitment to international trade, which can attract more business partners and clients.

5. Financial Benefits: Registration can make a business eligible for various incentives, such as tax breaks, subsidies, and financial assistance programs for exporters.

6. Access to Trade Information: Registered businesses often receive updates and insights about trade regulations, market trends, and opportunities.

7. Better Negotiation Power: Being officially registered can enhance a business’s negotiating power with suppliers and buyers, as it signals legitimacy and reliability.

8. Protection of Intellectual Property: Import/export registration helps in protecting intellectual property rights and trademarks in international markets.

If you’re considering registering for import/export activities, you may want to consult with a trade expert or legal advisor to understand the specific requirements and benefits applicable to your business.

Requirements:

The Importer Exporter Code (IEC) is required due to several key reasons that are fundamental for managing and regulating international trade activities. Here’s why IEC is a necessary requirement:

1. Regulatory Compliance: The IEC is mandated by the Directorate General of Foreign Trade (DGFT) in many countries. It ensures that businesses comply with national trade regulations and laws. Without it, a business cannot legally import or export goods.

2. Trade Monitoring and Control: The IEC helps government authorities monitor and control trade activities. It helps in tracking and regulating the flow of goods, ensuring that imports and exports are in line with national interests and trade policies.

3. Customs Clearance: To clear goods through customs, an IEC is required. It acts as an official identification number that allows customs authorities to process import and export transactions smoothly.

4. Avoiding Fraud and Smuggling: The IEC system helps in preventing fraudulent activities and smuggling. It ensures that only registered and legitimate businesses are involved in international trade.

5. Facilitating Trade Documentation: The IEC is needed for various trade-related documentation, including shipping bills, bills of entry, and other official paperwork. It streamlines the process of international trade by providing a standardized identification number.

6. Government Incentives: Many government schemes and incentives for exporters are linked to having an IEC. Businesses with an IEC can access benefits like export subsidies, duty drawbacks, and other trade-related incentives.

7. International Trade Relations: It establishes a formal identity for businesses in the global trade arena. Having an IEC demonstrates that a business is a registered and authorized entity for international trade.

In summary, the IEC is crucial for ensuring that businesses adhere to trade regulations, facilitate smooth trade operations, and gain access to various trade-related benefits and incentives.

Types:

In the context of international trade, there are several types of registration and licenses that businesses might need, depending on their activities. Here’s a brief overview of some common types:

1. Importer Exporter Code (IEC):

– Purpose: Required for all businesses engaged in importing or exporting goods and services.

– Issuing Authority: Directorate General of Foreign Trade (DGFT) or equivalent body.

2. Export License:

– Purpose: Needed for certain products or goods that require government authorization for export, such as sensitive items, controlled substances, or items subject to export restrictions.

– Issuing Authority: DGFT or relevant government department.

3. Import License:

– Purpose: Required for certain products or goods that require government authorization for import, often for controlled or restricted items.

– Issuing Authority: DGFT or relevant government department.

4. Customs Registration:

– Purpose: Required for businesses to clear goods through customs, ensuring compliance with import/export regulations and duties.

– Issuing Authority: Customs authorities in the respective country.

5. Certificate of Origin:

– Purpose: Certifies the origin of the goods being exported, which can affect tariffs and trade agreements.

– Issuing Authority: Chamber of Commerce or trade association.

6. FSSAI License (for food products):

– Purpose: Required for businesses exporting or importing food products to ensure compliance with food safety standards.

– Issuing Authority: Food Safety and Standards Authority of India (FSSAI) or equivalent authority.

7. BIS Certification (for specific products in India):

– Purpose: Required for certain products to ensure compliance with Indian standards.

– Issuing Authority: Bureau of Indian Standards (BIS).

8. CE Marking (for products in Europe):

– Purpose: Indicates that a product meets European Union safety, health, and environmental protection standards.

– Issuing Authority: Not issued by a specific authority but requires compliance with EU directives.

9. FDA Approval (for products in the U.S.):

– Purpose:** Required for certain products, particularly food and pharmaceuticals, to ensure they meet U.S. safety and regulatory standards.

– Issuing Authority:** U.S. Food and Drug Administration (FDA).

10. CTPAT Certification (for U.S. imports):

– Purpose: Ensures that international supply chains meet security standards to prevent terrorism and security threats.

– Issuing Authority: U.S. Customs and Border Protection (CBP).

The specific requirements for each type of registration or license can vary based on the nature of the business, the products involved, and the regulations of the country where the business operates.

Documents:

To obtain an Importer Exporter Code (IEC) for international trade, you’ll need to provide several documents as part of the registration process. Here is a typical list of documents required for IEC registration:

Documents Required for IEC Registration:

1. PAN Card:

– Purpose: Proof of identity and business tax registration.

– Requirement: Permanent Account Number (PAN) card of the business or individual.

2. Proof of Business Entity:

– Purpose: Verification of the business’s legal status.

– Requirement: Certificate of Incorporation (for companies), partnership deed (for partnerships), or business registration certificate (for sole proprietorships).

3. Proof of Address:

– Purpose: Verification of the business location.

– Requirement: Utility bills (electricity, water, or landline phone) or lease agreement showing the business address. The document should not be older than three months.

4. Bank Account Details:

– **Purpose:** Verification of the business’s financial transactions.

– **Requirement:** A canceled check or a bank statement from the business account, showing the account holder’s name and bank details.

5. Identity Proof of the Applicant:

– Purpose: Verification of the person applying for the IEC.

– Requirement: Aadhaar card, passport, or driver’s license of the applicant or the authorized signatory.

6. Application Form:

– Purpose: Formal request for IEC registration.

– Requirement: Complete the online application form available on the Directorate General of Foreign Trade (DGFT) website or the respective trade authority’s portal.

7. Digital Signature:

– Purpose: To authenticate the application.

– Requirement: A digital signature certificate (DSC) may be required for online applications, especially for companies.

Additional Documents (if applicable):

– Import/Export Business Proof: For businesses already engaged in import/export, additional proof of business activity may be required.

– GST Registration Certificate: In some cases, a Goods and Services Tax (GST) registration certificate might be needed.

Ensure that all documents are accurate, up-to-date, and correctly formatted to avoid delays in the registration process. The specific requirements can vary slightly depending on the country and the local regulations, so it’s a good idea to check with the relevant authorities or consult a professional for precise information.

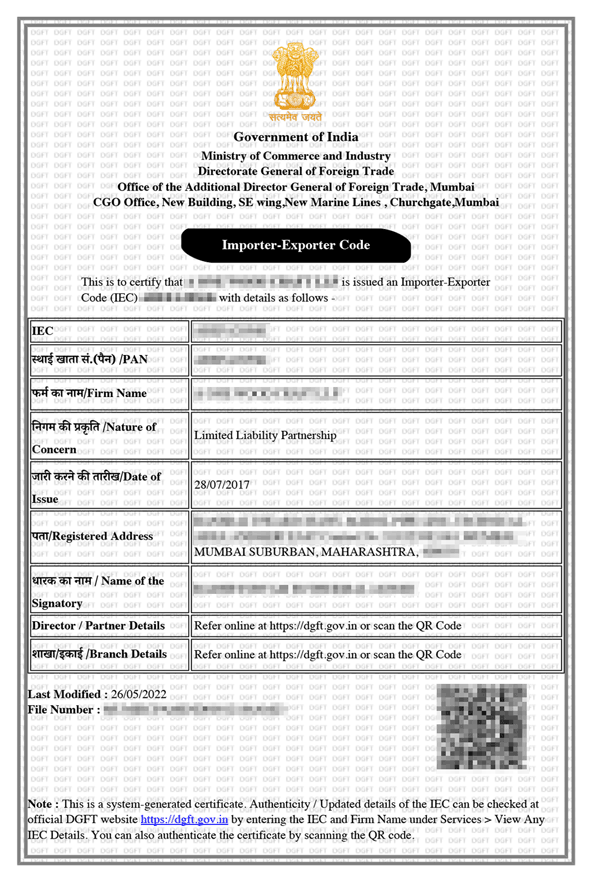

Sample Certificate

FAQs (Frequently Asked Questions)

- Import Export Code Number is unique 10 digit code number issued by Government of India. If a person is interested in making imports & exports, then it is mandatory for him to apply for Import Export Code Number (IEC).

IEC forms the primary document for recognition by Government of India as an Exporter/Importer. On the basis of IEC, companies can obtain various benefits on their exports/imports from DGFT, Customs, Export Promotion Council etc.

No. IEC forms a primary document for recognition by Govt. of India as Exporter / Importer. However, if value of goods is very low, the concerned customs officer may permit first export (only one time) by imposing penal charges.

Digital signature is used to validate online document submission. From 1st April, 2016, it is mandatory to validate the form and other documents using a digital signature. Click here to obtain your class II digital signature with 2 years validity.

Normal time to register an Importer / Exporter Code in India is 10 working days time.

The service is state specific in case you need a shop license and will be rendered only in specific cities being Mumbai, Gurgaon, Hyderabad, Kolkata, Jaipur, Surat, Bangalore, Chandigarh, Pune and Delhi.